Understanding your pay stub is essential for managing your finances effectively and ensuring accurate compensation from your employer. While pay stubs can seem complex at first glance, breaking down each component can demystify the information and empower you to make informed decisions about your income. In this article, we’ll guide you through the key elements of a pay stub, explaining what they mean and how to interpret them.

- The Anatomy of a Pay Stub

- Earnings

- Withholdings / Taxes

- Deductions and Contributions

- Common Paycheck Deductions

- Understanding Gross vs. Net Pay

- Year-to-Date (YTD) Totals

- Understanding Pay Codes and Earnings Categories

- How to Verify Your Pay Stub’s Accuracy

- Special Considerations for Different Pay Frequencies

- Digital Pay Stubs and Online Portals

- Frequently Asked Questions

- Keeping Your Pay Records

- Final Thoughts

The formatting may differ between payroll providers, but the information will be the same. Note that it is not uncommon for a human resource department or payroll provider to make mistakes, so it is essential to occasionally check this document for accuracy—particularly after making a change to your federal W-4 form or state withholding form.

The Anatomy of a Pay Stub

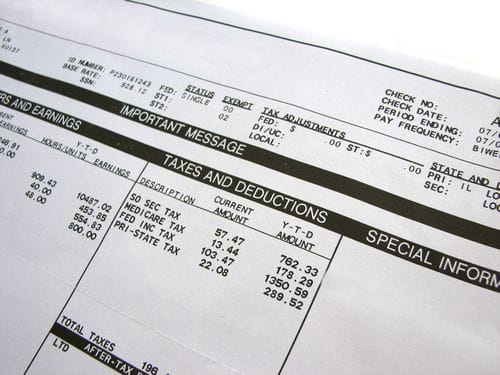

Your pay stub, also known as a paycheck statement or earnings statement, contains vital information about your earnings and deductions. Each section serves a specific purpose in documenting your compensation and withholdings.

The header portion typically displays your personal information and the pay period details:

- Employee name and ID number

- Company name and address

- Pay period dates

- Pay date

- Document number

Beyond these basics, your gross earnings are broken down into regular hours, overtime, bonuses, and other forms of compensation. This detailed breakdown helps you verify that you’re being paid correctly for all hours worked and additional earnings.

Earnings

The earnings section is where you’ll find details about your income for the pay period. This includes your gross earnings, which is the total amount you’ve earned before any deductions. Beneath gross earnings, you’ll see the breakdown of different types of income, such as regular wages, overtime pay, bonuses, and commissions. There may also be allowances in this section to compensate employees for personal expenditures, such as home internet and mobile phone services.

Withholdings / Taxes

This section outlines the various taxes withheld from your earnings, including federal income tax, state income tax (if applicable), and FICA taxes for Social Security and Medicare. Some of these may be abbreviated—for example, FIT and SIT for federal and state income tax. Understanding these deductions is important for accurately estimating your tax liability and ensuring compliance with tax laws.

Deductions and Contributions

In addition to taxes, your pay stub may include deductions for various benefits and contributions. This could include deductions for health insurance premiums, retirement contributions (such as 401(k) or IRA contributions), and voluntary deductions for items like life insurance, a health savings accounts (HSA), a flexible spending account (FSA), or charitable donations.

Reviewing these deductions can help you track your contributions to retirement accounts and understand both the value of employer-provided benefits and the effect of voluntary deductions on your paycheck. Abbreviations may be used for many if not all of these entries, so if any of them are a little too obscure, ask your human resources department to clarify.

Common Paycheck Deductions

Your pay stub lists several types of deductions that reduce your gross pay to arrive at your net pay:

Mandatory Deductions

- Federal Income Tax: Based on your W-4 withholding information

- State Income Tax (where applicable): Varies by state

- Social Security Tax (6.2% of wages up to the annual limit)

- Medicare Tax (1.45% of all wages)

Voluntary Deductions

- Health Insurance Premiums

- Retirement Plan Contributions (401(k), 403(b), etc.)

- Life Insurance Premiums

- Flexible Spending Account (FSA) Contributions

- Health Savings Account (HSA) Contributions

- Union Dues

- Charitable Contributions

Understanding Gross vs. Net Pay

One of the most important concepts in reading your pay stub is the distinction between gross and net pay. Your gross pay represents your total earnings before any deductions or taxes are taken out. This includes your base salary or hourly wages, overtime pay, bonuses, and other forms of compensation.

Net pay, often called “take-home pay,” is the amount you actually receive after all deductions and taxes have been subtracted from your gross pay. The difference between these two numbers can be substantial, which is why understanding the various deductions is important for financial planning.

Year-to-Date (YTD) Totals

Many pay stubs include year-to-date (YTD) totals for earnings, taxes, and deductions. These totals provide a snapshot of your income and deductions for the entire year, allowing you to track your financial progress over time. Reviewing YTD totals can help you identify trends in your earnings and expenses and make adjustments as needed. These running totals help you:

- Track your annual earnings

- Monitor your progress toward Social Security wage limits

- Verify tax withholdings

- Plan for tax season

- Budget effectively throughout the year

YTD figures are especially useful when preparing your annual tax returns and for spotting any discrepancies in your withholdings or deductions over time.

Understanding Pay Codes and Earnings Categories

Modern pay stubs often use codes to categorize different types of earnings and deductions. Common earnings codes might include:

- REG: Regular Hours

- OT: Overtime

- HOL: Holiday Pay

- VAC: Vacation Pay

- BONUS: Bonus Payment

- COMM: Commission

Similarly, deduction codes might appear as:

- FIT: Federal Income Tax

- SIT: State Income Tax

- SS: Social Security

- MED: Medicare

- 401K: Retirement Contribution

- INS: Insurance Premium

How to Verify Your Pay Stub’s Accuracy

Regular verification of your pay stub helps ensure you’re being paid correctly and that all deductions are accurate. Follow these steps:

- Check your basic information for accuracy

- Verify your hours worked match your records

- Confirm your pay rate is correct

- Check that overtime calculations are accurate

- Review all deductions for correctness

- Compare current figures with previous pay stubs

- Verify YTD totals are accumulating correctly

If you spot discrepancies, document them and contact your HR or payroll department promptly.

Special Considerations for Different Pay Frequencies

Pay frequency affects how you should interpret your pay stub:

- Weekly Pay: 52 paychecks per year

- Bi-weekly Pay: 26 paychecks per year

- Semi-monthly Pay: 24 paychecks per year

- Monthly Pay: 12 paychecks per year

Each frequency requires different calculations for monthly budgeting and understanding your annual salary. For example, to calculate your annual salary from bi-weekly pay, multiply your gross pay by 26.

Digital Pay Stubs and Online Portals

Many employers now provide digital pay stubs through online portals. These platforms often offer additional features:

- Historical pay stub access

- Tax document downloads

- Benefits information

- Deduction management tools

- Direct deposit settings

Understanding how to navigate these systems is increasingly important for managing your payroll information effectively.

Frequently Asked Questions

Q: What does YTD mean on a pay stub?

A: YTD (Year-to-Date) represents the total amount of earnings, deductions, or taxes from January 1st of the current year through the current pay period.

Q: How do you calculate gross pay from a pay stub?

A: Gross pay is the total of all earnings before any deductions. Add together base pay, overtime, bonuses, and any other forms of compensation shown on the stub.

Q: What percentage of my paycheck is typically withheld for federal tax?

A: Federal tax withholding varies based on your W-4 elections and income level, but typically ranges from 10% to 37% of taxable income.

Q: How do I know if federal taxes are coming out of my check correctly?

A: Compare your withholdings to the IRS withholding tables based on your W-4 information, filing status, and income level. The IRS website offers a withholding calculator for verification.

Keeping Your Pay Records

Maintain copies of your pay stubs for these important reasons:

- Proof of income for loans or rentals

- Tax preparation documentation

- Employment verification

- Benefits eligibility confirmation

- Resolution of payment disputes

Most financial experts recommend keeping pay stubs for at least one year, and longer if you’re self-employed or have complicated tax situations. If your pay stubs are only available via your employer’s online portal, keep in mind that your access may be removed after leaving the company. Be sure to download and save these documents.

Final Thoughts

Understanding your pay stub is more than just knowing how much money you’ll receive. It’s about ensuring accurate payment, managing your tax withholdings, budgeting effectively, and planning your financial future. Take time to review pay stubs regularly and don’t hesitate to ask your employer or payroll department about any items you don’t understand. Financial literacy starts with understanding your earnings, and your pay stub is the key to that knowledge.