What if I told you that one of the most successful investment strategies doesn’t require timing the market, picking individual stocks, or having extensive financial knowledge? Dollar-cost averaging represents one of the most powerful yet simple approaches to building long-term wealth. This systematic investment method has helped countless investors navigate market volatility while steadily growing their portfolios over time.

Key Takeaways: Master Dollar-Cost Averaging for Long-Term Success

- Consistency beats timing – Regular investments regardless of market conditions outperform attempts to time the market

- Volatility becomes your friend – Market fluctuations allow you to buy more shares when prices are low and fewer when high

- Emotional discipline pays off – Automated investing removes fear and greed from investment decisions

- Start small, think big – You can begin with as little as $25-100 monthly and increase over time

- Diversified funds work best – Index funds and ETFs provide the stability and growth potential ideal for this strategy

- Time amplifies results – The longer you maintain the strategy, the more powerful compound growth becomes

The beauty of dollar-cost averaging lies in its simplicity and effectiveness. Rather than trying to predict market movements, you invest a fixed amount regularly, regardless of market conditions. This approach removes emotional decision-making from investing and harnesses the power of time and consistency to build substantial wealth.

- What Is Dollar-Cost Averaging and How Does It Work?

- The Science Behind Dollar-Cost Averaging Success

- Dollar-Cost Averaging vs. Lump Sum Investing

- Optimal Frequency: Weekly, Monthly, or Quarterly Investments?

- Choosing the Right Investments for Dollar-Cost Averaging

- Common Mistakes to Avoid with Dollar-Cost Averaging

- Dollar-Cost Averaging in Different Market Conditions

- Maximizing Your Dollar-Cost Averaging Strategy

- Frequently Asked Questions

- Building Your Wealth Through Systematic Investing

What Is Dollar-Cost Averaging and How Does It Work?

Dollar-cost averaging is an investment strategy where you invest a fixed dollar amount in a particular investment at regular intervals, regardless of the asset’s price. When prices are high, your fixed investment amount buys fewer shares. When prices are low, that same amount purchases more shares. Over time, this approach can result in a lower average cost per share compared to making large, one-time investments.

The mechanics are straightforward. Suppose you decide to invest $500 monthly in an index fund. In January, when the fund’s price is $50 per share, you purchase 10 shares. In February, if the price drops to $40 per share, your $500 buys 12.5 shares. In March, if the price rises to $60 per share, you get 8.33 shares. Over these three months, you’ve purchased shares at different prices, potentially reducing your overall average cost.

This systematic approach eliminates the guesswork and emotional stress of trying to time market entries and exits. You’re not concerned with whether the market is up or down on any given day because you’re consistently investing through all market conditions. The strategy works particularly well with volatile investments, as the price fluctuations actually work in your favor by allowing you to accumulate more shares during market downturns.

The Science Behind Dollar-Cost Averaging Success

The effectiveness of dollar-cost averaging stems from several mathematical and psychological principles that work together to benefit long-term investors. The strategy leverages volatility to your advantage through what’s known as the volatility drag effect. When you buy more shares at lower prices and fewer shares at higher prices, you naturally achieve a lower average purchase price than the arithmetic mean of the prices during your investment period.

Research has consistently shown that dollar-cost averaging reduces the impact of volatility on large purchases of financial securities. A study by Vanguard demonstrated that while lump-sum investing often produces better returns in rising markets, dollar-cost averaging provides superior risk-adjusted returns and helps investors stick to their investment plans during turbulent periods. For example:

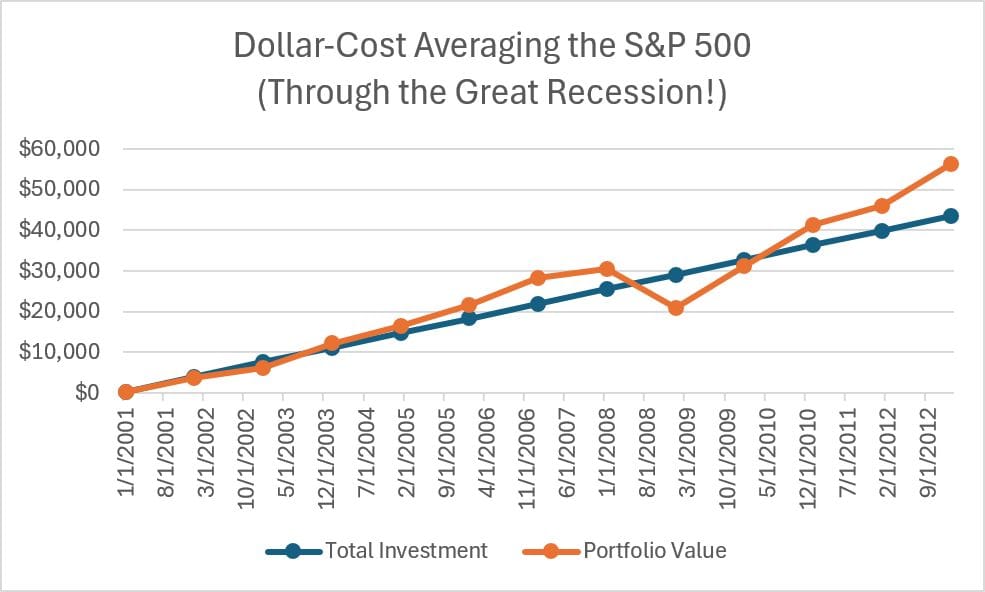

Above is a demonstration of what can happen over a 12-year period of consistent $300 monthly investments using actual S&P 500 historical data. I purposely included the Great Recession in this date range to show how this long-term investment method can overcome even severe market downturns.

The psychological benefits are equally important. Dollar-cost averaging removes the burden of market timing decisions that often lead to poor investment outcomes. Many investors fall victim to emotional investing, buying high during market euphoria and selling low during market panic. By committing to regular investments regardless of market conditions, you avoid these costly emotional mistakes.

Additionally, the strategy creates a disciplined investment routine that builds wealth through the power of compound growth. Each regular investment not only adds to your portfolio but also begins earning returns immediately, contributing to the snowball effect of compound interest over time.

Dollar-Cost Averaging vs. Lump Sum Investing

The debate between dollar-cost averaging and lump sum investing has been ongoing among financial professionals for decades. Each approach has distinct advantages depending on market conditions, risk tolerance, and individual circumstances.

Lump sum investing involves investing a large amount of money all at once rather than spreading it out over time. Historically, lump sum investing has produced higher returns about two-thirds of the time because markets generally trend upward over long periods. When you invest a large amount immediately, you give your entire investment more time to grow in rising markets.

However, dollar-cost averaging offers significant advantages in terms of risk management and behavioral finance. The strategy reduces timing risk, which is the possibility of investing a large sum just before a market decline. During the 2008 financial crisis, investors who had recently made large lump sum investments saw devastating losses, while those using dollar-cost averaging continued buying shares at increasingly attractive prices.

The choice between these strategies often depends on your financial situation and psychological comfort level. If you have a large sum to invest and can handle the potential volatility of seeing that entire amount fluctuate with market movements, lump sum investing might be appropriate. If you prefer a more measured approach that helps you sleep better at night, dollar-cost averaging provides peace of mind along with solid long-term returns.

For most investors, especially those building wealth through regular savings from their income, dollar-cost averaging is the natural choice. You’re investing as you earn, making the strategy both practical and effective for long-term wealth building.

Optimal Frequency: Weekly, Monthly, or Quarterly Investments?

Determining the optimal frequency for your dollar-cost averaging strategy requires balancing several factors including transaction costs, market volatility, and convenience. The frequency of your investments can impact both your returns and the effectiveness of the strategy.

Monthly investing represents the sweet spot for most investors implementing dollar-cost averaging. This frequency provides sufficient exposure to market volatility to capture the benefits of the strategy while keeping transaction costs reasonable. Monthly investments also align well with most people’s income schedules, making it easier to maintain consistency.

Weekly investing can potentially provide better dollar-cost averaging effects in highly volatile markets because you’re making more frequent purchases at different price points. However, the benefits often don’t justify the increased complexity and potential transaction costs. Unless you’re investing in commission-free funds or ETFs, weekly investing can erode returns through fees.

Quarterly investing, while less frequent, still provides meaningful dollar-cost averaging benefits and may be suitable for investors who prefer less frequent monitoring of their portfolios. The longer intervals between investments mean you’ll experience more price variation between purchases, which can enhance the averaging effect during volatile periods.

The key is choosing a frequency you can maintain consistently over long periods. Consistency trumps optimization when it comes to dollar-cost averaging success. Whether you choose weekly, monthly, or quarterly investments, the most important factor is sticking to your schedule through all market conditions.

Choosing the Right Investments for Dollar-Cost Averaging

The effectiveness of dollar-cost averaging depends significantly on choosing appropriate investments that align with your long-term goals and risk tolerance. Not all investments are equally suited for this systematic approach.

Index funds and exchange-traded funds (ETFs) represent ideal candidates for dollar-cost averaging strategies. These diversified investments spread risk across hundreds or thousands of securities, reducing the impact of any single company’s performance on your portfolio. The broad diversification also ensures that you’re capturing the overall market’s long-term growth trend rather than betting on individual stock performance.

Target-date funds offer another excellent option for dollar-cost averaging, especially for retirement investing. These funds automatically adjust their asset allocation to become more conservative as you approach your target retirement date. This feature makes them particularly suitable for long-term dollar-cost averaging strategies where you want professional management of the risk level over time.

Individual stocks can work for dollar-cost averaging, but they require more careful selection and monitoring. Blue-chip stocks with long histories of stability and dividend payments can be suitable for this approach. However, concentrating your dollar-cost averaging in individual stocks increases your risk compared to diversified funds.

Volatile investments actually work well with dollar-cost averaging because the price fluctuations allow you to purchase more shares during downturns and fewer during peaks. This volatility enhances the averaging effect, potentially improving your long-term returns compared to less volatile investments.

Common Mistakes to Avoid with Dollar-Cost Averaging

Even with its straightforward approach, investors can make several mistakes that reduce the effectiveness of their dollar-cost averaging strategy. Understanding these pitfalls helps ensure you maximize the benefits of this proven investment method.

The most common mistake is inconsistency in making investments. Market downturns often trigger fear responses that cause investors to pause or stop their regular investments just when the strategy could be most beneficial. During the 2020 market crash, many investors who had been successfully dollar-cost averaging for years suddenly stopped investing, missing the opportunity to purchase shares at deeply discounted prices.

Another frequent error is constantly changing investment amounts based on market conditions or personal emotions. Some investors increase their investments during market highs out of greed and reduce them during market lows out of fear. This behavior defeats the purpose of dollar-cost averaging and often leads to poor timing decisions.

Choosing inappropriate investments can also undermine your strategy. Highly speculative investments, penny stocks, or overly concentrated positions don’t provide the stability and diversification that make dollar-cost averaging most effective. Stick to quality, diversified investments that align with your long-term objectives.

Many investors also make the mistake of stopping their dollar-cost averaging strategy too early. The benefits of this approach compound over time, and interrupting the process during short-term market volatility can significantly impact long-term results. Successful dollar-cost averaging requires a commitment to continue investing through multiple market cycles.

Dollar-Cost Averaging in Different Market Conditions

Understanding how dollar-cost averaging performs across various market environments helps set realistic expectations and maintain confidence in your strategy during challenging periods. The approach provides different benefits depending on whether markets are rising, falling, or moving sideways.

In rising markets, dollar-cost averaging may underperform lump sum investing because you’re gradually entering positions rather than investing everything at lower prices. However, the strategy still produces positive returns while providing the psychological benefit of reducing regret if markets suddenly reverse. You’re participating in the market’s upward movement while maintaining a disciplined approach to investing.

Bear markets represent where dollar-cost averaging truly shines. As prices decline, your fixed investment amount purchases more shares at increasingly attractive prices. This accumulation of shares at lower costs positions your portfolio for significant gains when markets recover. The 2008-2009 financial crisis provided a perfect example, as investors who continued dollar-cost averaging through the downturn achieved excellent returns during the subsequent recovery.

Sideways or volatile markets with no clear trend also favor dollar-cost averaging strategies. The price fluctuations allow you to buy more shares during dips and fewer during peaks, potentially achieving better average prices than random investment timing. These market conditions highlight the strategy’s ability to smooth out the impact of volatility on your investment returns.

The key insight is that dollar-cost averaging provides benefits across all market conditions, though the specific advantages vary. The strategy’s consistency and discipline help you navigate different market environments while building wealth over time.

Maximizing Your Dollar-Cost Averaging Strategy

To optimize your dollar-cost averaging approach, consider several advanced techniques that can enhance your long-term wealth-building results. These strategies build upon the basic concept while adding sophistication to your investment process.

Combining dollar-cost averaging with value averaging can potentially improve your returns. Value averaging involves adjusting your investment amounts to achieve a target portfolio value growth rate. When your portfolio underperforms, you invest more than your regular amount. When it outperforms, you invest less or even sell shares. This approach can enhance returns but requires more active management and discipline.

Tax-loss harvesting within your dollar-cost averaging strategy can improve after-tax returns in taxable accounts. By occasionally selling investments that have declined in value to realize losses for tax purposes, then immediately repurchasing similar investments, you can reduce your tax burden while maintaining your market exposure.

Automating your dollar-cost averaging strategy eliminates the temptation to skip investments or second-guess your timing. Most brokerages offer automatic investment plans that can execute your strategy without manual intervention. This automation ensures consistency and removes emotional decision-making from the process.

Consider implementing a tiered approach where you increase your investment amounts as your income grows. Starting with smaller amounts and gradually increasing them over time allows you to maintain your lifestyle while steadily building wealth. This approach recognizes that your capacity to invest typically grows with your career progression.

Frequently Asked Questions

Is dollar-cost averaging better than investing a lump sum?

Dollar-cost averaging reduces timing risk and provides psychological comfort, while lump sum investing historically produces higher returns about two-thirds of the time. The best choice depends on your risk tolerance, available funds, and emotional comfort with market volatility.

How often should I invest using dollar-cost averaging?

Monthly investments offer the best balance of capturing averaging benefits while minimizing transaction costs and complexity. Weekly investing can work for commission-free investments, while quarterly investing still provides meaningful benefits with less frequent attention required.

What investments work best with dollar-cost averaging?

Diversified index funds, ETFs, and target-date funds work exceptionally well because they spread risk and capture overall market returns. Individual stocks can work but require more careful selection and increase concentration risk.

Should I continue dollar-cost averaging during market crashes?

Yes, market downturns present excellent opportunities for dollar-cost averaging because your fixed investment amount purchases more shares at lower prices. Stopping during crashes eliminates one of the strategy’s primary benefits.

Can I use dollar-cost averaging for retirement accounts?

Absolutely. Dollar-cost averaging works excellently in 401(k)s, IRAs, and other retirement accounts. The tax-advantaged growth combined with systematic investing creates a powerful wealth-building combination.

What’s the minimum amount needed to start dollar-cost averaging?

Many brokerages and fund companies allow you to start with as little as $25-100 per month. The key is choosing an amount you can consistently invest without straining your budget.

How long should I continue dollar-cost averaging?

Dollar-cost averaging works best as a long-term strategy spanning decades rather than years. Continue the approach throughout your wealth-building years, potentially transitioning to different strategies as you near retirement.

Building Your Wealth Through Systematic Investing

Dollar-cost averaging represents more than just an investment strategy—it’s a philosophy of disciplined, long-term wealth building that removes emotion and guesswork from investing. By committing to regular investments regardless of market conditions, you harness the power of time, consistency, and market volatility to build substantial wealth over time.

The strategy’s effectiveness stems from its simplicity and psychological benefits as much as its mathematical advantages. You’re not trying to outsmart the market or time perfect entry points. Instead, you’re participating in the market’s long-term growth while protecting yourself from the devastating effects of emotional investing decisions.

Success with dollar-cost averaging requires patience, consistency, and faith in the long-term growth of quality investments. Markets will experience volatility, economic uncertainty, and periodic downturns. Your dollar-cost averaging strategy not only helps you weather these storms but positions you to benefit from them through the accumulation of shares at attractive prices.

Start your dollar-cost averaging journey today, even if you can only invest small amounts initially. The power of this strategy lies not in the size of individual investments but in their consistency over time. Every month you delay starting is a month less of potential compound growth working in your favor.

Remember that building wealth is a marathon, not a sprint. Dollar-cost averaging provides the steady, disciplined approach that turns this marathon into a achievable goal. Begin with whatever amount fits your budget, automate the process, and let time and consistency work their magic on your financial future.