Understanding credit card billing cycles is vital for managing your finances effectively. The cycle begins with the opening date, encompassing charges until the closing date, which determines what appears on your statement for that period. The statement date, following the closing date, marks the generation of your credit card statement and the transmission of important information to credit reporting agencies.

Utilizing the grace period between the statement and payment due dates wisely can help avoid interest charges, late fees, and penalty APRs, ultimately safeguarding your financial health. Learn more about navigating your credit card obligations to make informed decisions about payments and debt management.

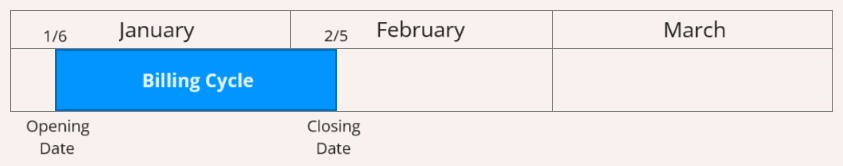

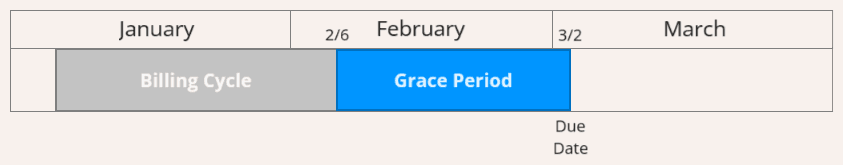

Note that the dates shown in the illustrations below are examples, and will differ between banks and from month to month.

Opening/Closing Dates

Charges that occur during this date range will appear on your statement for this billing cycle. Any charges made after the closing date are included in the next billing cycle, even though you have yet to be billed for the current cycle:

Statement Date

This is the date your credit card statement is generated, and it will match the closing date or be within a few days following it.

This is also the time when your statement balance, credit limit, and other information are sent to credit reporting agencies. For this reason, if you plan to apply for a loan in the next few weeks and want to optimize your FICO scores by decreasing credit utilization, it is vital to make any large payments on or before the closing date. If you wait until after the closing date, credit bureaus will have the balance information shown on the most recent statement, and it will not be updated again until the following statement date a month later.

Grace Period

Most banks offer a grace period, although they are not required to do so by law. The grace period is the time between the statement date and the payment due date. Purchases made during this date range are not included when calculating interest for the upcoming due date—interest is only charged on purchases from the associated billing cycle, as well as balances carried over from previous billing cycles. Grace periods do not typically apply to cash advances or balance transfers. A typical grace period for a credit card is between 21 and 25 days, but those for business accounts may fall outside of this range:

The start date of the grace period also marks the beginning of the next billing cycle, which is followed by its own grace period:

As you can see, the grace period for the previous billing cycle overlaps with the current billing cycle.

Payment Due Date

Unlike some other types of bills, paying a credit card account even one day late can bring severe penalties—including a late fee and an increased interest charge known as a “penalty APR,” which can be as high as 29.99%. If you have very high balances, this can amount to hundreds of dollars monthly, and the penalty could stay in effect for six full months after you bring your account current. To avoid this, it’s best to set up automatic payments for at least the minimum amount due.

This minimum amount is usually based on a percentage of your last statement balance, or if you have a very low balance, a flat rate minimum. Both the percentage and flat rate will vary between banks. For example, you may be charged a minimum of 2% on a $5,000 balance ($100), or $40 on a $500 balance.

Your monthly account statement will contain a summary of your bank’s terms and conditions, with more information on how interest is charged as well as late payment penalties.

If you have numerous debt obligations and are unsure of how to go about paying them off, please see our Debt Payoff Methods article for guidance.