Being underneath a mountain of debt can feel overwhelming, even if you can afford to eventually dig your way out. We believe that a large part of that stress comes from not having a clear picture of your own financial situation. There will always be at least some unknowns, but the things that can be known are frequently the most important.

Having these facts in hand can provide both hope and a sense of control, because they enable you to form a concrete plan. Having a plan allows you to see a light at the end of the tunnel. Even if the light is dim and far away, it’s a psychological boost that you simply don’t get when there’s no light at all.

The Strategy

That’s where debt payoff methods come in. Instead of only seeing bills that seemingly never end, and balances that barely budge from paycheck to paycheck, these methods first force you to acknowledge and document your debts, and then follow a single rule—focus on one debt while paying the minimum on all others. You may cringe at the thought of paying mostly interest on some of your other debts, but these methods work, and you can experience that for yourself.

With any time spent researching, you’ve probably heard of at least two of these strategies. This article includes examples of the effect of each, but we wanted to take it a step further—so we created a tool that will allow you to see them working in your own situation, without having to go through the extremely tedious task of calculating them in a spreadsheet. You’ll find that tool on our Debt Payoff Methods Calculator page.

The debt you select as the focus is a matter of some contention. There are three strategies, each with unique advantages and disadvantages. In the examples shown below, it is assumed that the income available for paying debt is $1,000 per month.

Lowest Balance

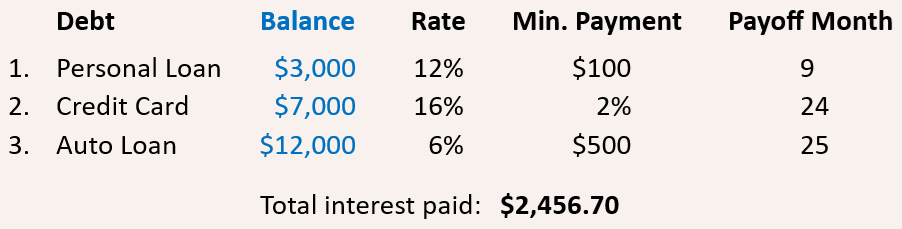

Also known as the debt snowball method, this strategy focuses on repaying the debt with the lowest balance, followed by the debt with the next lowest balance, etc. This provides an undeniable psychological boost, as tangible progress is made earlier rather than later, but that progress may come at the expense of additional interest:

Highest Interest

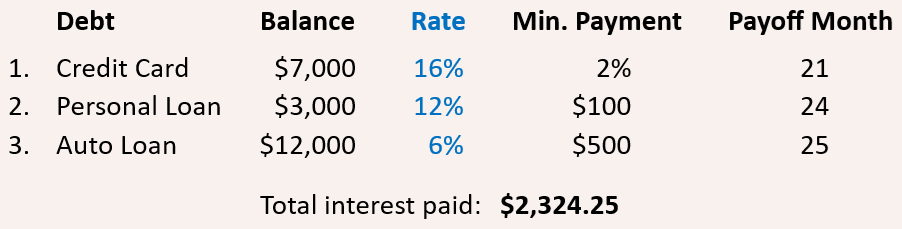

The debt avalanche method will usually save the most money in interest, but lacks the quick reward of the snowball method, which can result in a lower chance of success:

Highest Payment-to-Balance Ratio

Less well-known is the cash flow method, which prioritizes freeing up monthly income. Of course, that income will still be used to pay down other debts, but having it available would be useful in the case of an unexpected expense. To calculate the ratio, simply divide each debt’s minimum payment by the balance:

In the case of our sample data, the downside of this strategy is obvious, but keep in mind that each debt situation is unique—there are scenarios where the cash flow method makes more sense than either of the other two, both financially and emotionally. For example, if the auto loan balance was only $3,000, you would almost certainly want to pay it off before the personal loan, regardless of the difference in interest rate. Also note that over time the ratio will change for debts with a variable minimum payment amount, as is the case with credit cards.

Choosing a Method

This is the easy part. The debt payoff method you select is not nearly as important as the act of focusing on one debt at a time, which is the basis of all three strategies. You are also free to switch at any time—even before you finish paying off your current focus debt.