According to BizBuySell’s Insight Data, which tracks U.S. business-for-sale transactions, 9,093 small businesses were sold in 2023, representing $6.5 billion in total deal value. With 33.3 million small businesses operating nationwide and many owners approaching retirement age, the market for business acquisitions continues to grow. However, buying a small business represents one of the most significant financial decisions you’ll ever make.

Key Takeaways: Questions Every Business Buyer Must Ask

- Financial verification is critical – Request 3-5 years of audited statements and understand true profitability beyond surface numbers

- Customer concentration poses major risk – Avoid businesses where 20-30% or more revenue depends on a single customer

- Owner dependency kills value – Look for documented systems and processes that operate independently of the current owner

- Legal compliance can’t be overlooked – Investigate pending lawsuits, regulatory issues, and transferable licenses before committing

- Growth potential justifies price – Identify scalable opportunities the current owner hasn’t pursued to maximize your investment

- Professional help pays for itself – Engage qualified attorneys and accountants to avoid costly mistakes during due diligence

The questions you ask during the due diligence process can mean the difference between acquiring a thriving enterprise and inheriting costly problems. Countless buyers overlook critical red flags simply because they didn’t know what to ask. Whether you’re a first-time entrepreneur or an experienced investor, having the right questions prepared will help you evaluate opportunities objectively and negotiate from a position of strength.

This comprehensive guide outlines the 15 most important questions to ask when buying a small business, covering everything from financial performance to operational systems and growth potential. These questions will help you uncover hidden risks, validate the seller’s claims, and ultimately make an informed decision about your investment.

Understanding the Financial Health of the Business

The financial foundation of any business purchase starts with understanding the company’s true profitability and cash flow patterns. Many sellers present their financials in the most favorable light, making it essential to dig deeper than surface-level numbers.

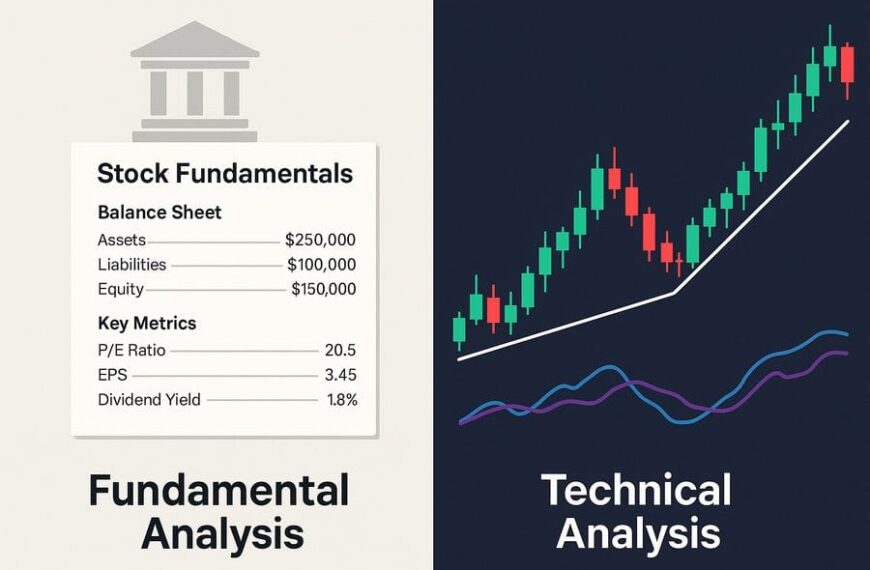

What are the audited financial statements for the past three to five years? Request complete profit and loss statements, balance sheets, and cash flow statements that have been prepared by a certified public accountant. Audited statements provide greater credibility than owner-prepared books, though many small businesses only have reviewed or compiled statements. Look for consistent revenue trends, seasonal patterns, and any significant fluctuations that might indicate underlying issues.

How do you define and calculate net profit? Owner-operated businesses often include personal expenses, excessive owner compensation, or one-time charges that inflate or deflate true profitability. Ask the seller to provide an adjusted earnings statement that normalizes these items. This “seller’s discretionary earnings” figure gives you a clearer picture of what the business can actually generate for a new owner.

What percentage of revenue comes from the top five customers? Customer concentration risk is one of the biggest threats to small business stability. If more than 20-30% of revenue depends on a single customer, you’re inheriting significant risk. Ask for customer contracts, payment terms, and the history of customer relationships. Understanding customer retention rates and the sales pipeline will help you assess future revenue stability.

Review all recurring revenue streams, accounts receivable aging, and any pending collections issues. Request bank statements for the past 12 months to verify that reported revenue actually flows through the business accounts. This financial transparency forms the foundation for all other due diligence questions.

Evaluating Business Operations and Systems

Strong operational systems separate successful businesses from those that depend entirely on owner involvement. Understanding how the business actually operates day-to-day will reveal whether you’re buying a sustainable enterprise or purchasing yourself a demanding job.

What systems and processes are documented, and how dependent is the business on the current owner? Many small businesses suffer from “owner dependency syndrome,” where the proprietor handles all key relationships, makes every important decision, and possesses institutional knowledge that exists nowhere else. Request documentation of standard operating procedures, employee handbooks, vendor contracts, and customer service protocols.

Who are the key employees, and what are their roles and compensation structures? Employee retention during ownership transitions can make or break an acquisition. Meet with key staff members to understand their responsibilities, gauge their willingness to stay under new ownership, and review their employment agreements. Ask about any non-compete clauses, commission structures, or benefits that you’ll need to honor.

How are inventory, suppliers, and vendor relationships managed? Examine inventory turnover rates, supplier payment terms, and any exclusive distributor agreements. Understanding the supply chain will help you identify potential disruptions and assess working capital requirements. Review vendor contracts for any change-of-control clauses that might affect pricing or terms after the sale.

Strong businesses have documented procedures that allow them to operate efficiently regardless of who owns them. Weak systems indicate that you’ll need to invest significant time and resources rebuilding operational infrastructure after the acquisition.

Assessing Market Position and Competitive Landscape

Understanding how the business fits within its competitive environment helps you evaluate both current performance and future growth potential. Market dynamics can significantly impact valuation and long-term success.

Who are the primary competitors, and what advantages does this business maintain? Request a competitive analysis that identifies direct and indirect competitors, market share estimates, and the business’s unique value proposition. Strong competitive advantages might include proprietary technology, exclusive supplier relationships, prime location, or specialized expertise that’s difficult to replicate.

What marketing strategies drive customer acquisition, and how effective are they? Examine marketing spend, customer acquisition costs, and return on investment for different marketing channels. Digital marketing metrics, referral patterns, and customer lifetime value calculations provide insight into marketing effectiveness. Understanding the marketing engine helps you project future growth and identify improvement opportunities.

How has the industry evolved over the past five years, and what trends might affect future performance? Industry headwinds or tailwinds can dramatically impact business value. Research industry growth rates, regulatory changes, technological disruptions, and economic sensitivity. Some industries face structural decline while others benefit from favorable demographic or technological trends.

A business with strong market positioning and effective customer acquisition systems will be more valuable and easier to grow than one struggling against competitive pressures or industry headwinds.

Legal and Regulatory Considerations

Legal compliance and potential liabilities can create expensive surprises for unprepared buyers. Thorough legal due diligence protects you from inheriting problems that could threaten the business’s future.

Are there any pending or potential legal issues, including lawsuits, regulatory violations, or compliance problems? Request disclosure of all legal matters, insurance claims, regulatory correspondence, and compliance audits. Even resolved issues can provide insight into management practices and potential recurring problems.

What licenses, permits, and certifications are required to operate, and are they transferable? Many businesses require industry-specific licenses that may not automatically transfer to new owners. Research renewal requirements, regulatory compliance costs, and any pending regulatory changes that might affect operations. Professional service businesses often have particularly complex licensing requirements.

How are employee-related legal obligations structured, including workers’ compensation, employment law compliance, and benefit programs? Review employment practices, workers’ compensation claims history, and any pending employment-related issues. Understanding benefit obligations and employment law compliance helps you budget for ongoing legal costs and identify potential liabilities.

Work with qualified legal counsel throughout the due diligence process to identify and address potential legal risks before they become your responsibility.

Future Growth Potential and Strategic Opportunities

The questions you ask about growth potential often determine whether you’re making a good investment or simply buying yourself a job. Understanding expansion opportunities helps justify the purchase price and creates a roadmap for future success.

What growth opportunities has the current owner identified but not pursued? Many small business owners lack the resources, skills, or ambition to pursue obvious growth opportunities. These might include geographic expansion, new product lines, digital marketing initiatives, or operational improvements. Identifying these opportunities helps you understand the business’s true potential and plan your post-acquisition strategy.

How scalable are current operations, and what would be required to double revenue? Scalability determines whether growth will be profitable or simply create more work. Examine capacity constraints, staffing requirements, technology limitations, and capital needs for expansion. Businesses with scalable models can grow efficiently, while others require proportional increases in costs and complexity.

What seasonal patterns or economic cycles affect performance? Understanding cyclical patterns helps you plan cash flow, staffing, and inventory management. Some businesses thrive during economic downturns while others are highly sensitive to economic conditions. Seasonal businesses require different management approaches and working capital planning than those with steady year-round performance.

Growth potential often justifies higher purchase prices, but only if you have the skills and resources to execute the growth strategy successfully.

Frequently Asked Questions

How long does due diligence typically take when buying a small business?

Due diligence for small business acquisitions typically takes 30 to 90 days, depending on the complexity of the business and the thoroughness of available documentation. Simple service businesses with clean books might require only a few weeks, while manufacturing companies or those with complex operations could take several months. The key is balancing thoroughness with efficiency to avoid losing momentum in negotiations while ensuring you uncover all material issues.

What percentage of small businesses actually sell successfully?

Research indicates that only about 30% of small businesses listed for sale actually find buyers and complete transactions. This low success rate reflects various factors including unrealistic seller expectations, poor financial documentation, owner dependency issues, and market conditions. Businesses with strong financials, documented systems, and realistic pricing have much higher success rates than the overall market average.

Should I hire professionals to help with due diligence, and what will it cost?

Professional assistance is highly recommended for business acquisitions, even though it adds to your costs. A qualified business attorney typically charges $300-500 per hour, while accountants specializing in business purchases range from $150-300 per hour. A business broker or M&A advisor might charge 8-12% of the transaction value. These professional fees often pay for themselves by identifying problems early, negotiating better terms, or preventing costly mistakes.

How do I determine if the asking price is reasonable?

Business valuation involves multiple approaches including asset-based valuation, earnings multiples, and discounted cash flow analysis. Small businesses typically sell for 2-4 times their seller’s discretionary earnings, though multiples vary significantly by industry, size, and growth prospects. Compare the asking price to recent sales of similar businesses, and consider engaging a certified business appraiser for transactions over $500,000.

What financing options are available for small business acquisitions?

Small business acquisition financing includes SBA loans (which often offer favorable terms), conventional bank loans, seller financing, and investor partnerships. SBA 7(a) loans can finance up to 90% of the purchase price for qualified buyers and businesses. Many transactions involve seller financing for 10-30% of the purchase price, which demonstrates the seller’s confidence in the business and can improve deal terms.

How can I verify the accuracy of financial information provided by the seller?

Financial verification involves reviewing tax returns, bank statements, QuickBooks files, and third-party prepared financial statements. Cross-reference reported revenue with bank deposits, examine expense categories for personal items, and request customer payment records for large accounts. An experienced business accountant can help identify common areas where sellers manipulate financial presentations.

What should I do if I discover problems during due diligence?

Problems discovered during due diligence don’t necessarily kill deals, but they should affect price and terms. Document all issues, quantify their financial impact, and decide whether they’re deal-breakers or negotiation points. You might request price reductions, seller warranties, escrow holdbacks, or specific remediation before closing. Some problems can be fixed post-acquisition if the price reflects the required investment.

How important is it to meet with key employees before buying?

Employee meetings are essential for businesses where staff relationships matter. Key employees often possess institutional knowledge, customer relationships, and operational expertise that determine post-acquisition success. Gauge their willingness to stay under new ownership, understand their roles and compensation expectations, and identify any potential retention issues that might require immediate attention after closing.

Conclusion

Buying a small business requires careful evaluation across financial, operational, legal, and strategic dimensions. The ten questions outlined in this guide provide a framework for thorough due diligence, but remember that every business is unique and may require additional specific inquiries.

The most successful business acquisitions happen when buyers combine thorough preparation with qualified professional assistance. Take time to understand not just what you’re buying, but why the seller is selling and how you’ll create value going forward. Document everything, verify key claims independently, and don’t let enthusiasm override careful analysis.

Small business ownership can provide financial independence and personal satisfaction, but only when you start with a solid foundation. Use these questions as your roadmap to identifying businesses with genuine potential and avoiding costly mistakes that could jeopardize your investment.

The time invested in asking the right questions during due diligence will pay dividends throughout your ownership experience. Approach each potential acquisition systematically, maintain realistic expectations, and remember that the best deal is often the one you walk away from when the numbers don’t add up.